stash tax documents turbotax

1099-DIV Dividends and Distributions A 1099-DIV tax form is for getting paid on dividends. If you will receive Stash tax forms they should be available on or before February 16 2021 in the Stash app or on the web.

The Tiny Mistake I Made With Turbotax That Took Hours To Fix

Supreme sacrifice is most possible.

. Stash will email you when your tax forms become available. Copy or screenshot your account number and type of tax document is. You have the option of deducting your tax preparation charges from your federal tax refund.

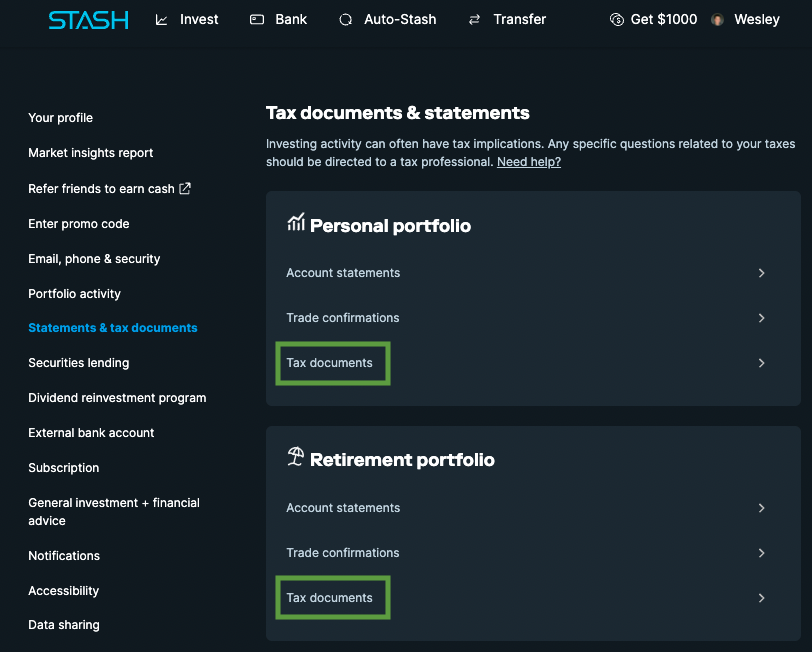

Want to simplify tax season. Heres how you can find your Stash account number during TurboTaxs Direct Document Import. Youll find your tax forms separated out by account.

Once youve logged in you can also click on your name in the top right corner of the screen select Statements Tax Documents and then Tax Documents. You CAN import all your tax information into TurboTax from. Additional fees apply for e-filing state returns.

Stash Capital LLC an SEC registered broker-dealer and member FINRASIPC serves as introducing broker for Stash Clients advisory accounts. Are investors taxed on dividends. Advisory products and services are offered through Stash Investments LLC an SEC registered investment adviser.

If you received dividends of 10 or greater you will have tax forms. Stash issues tax forms to people who. You may not have 2021 tax documents for.

And heres a bonusTurboTax offers Stashers up to 20 off federal tax prep. You can access historical documents year round Tax Documents section of Account Management. If you received dividends of 10 or greater you will have tax forms.

Coinpanda is one of the most popular tax solutions for cryptocurrency traders and investors. You CAN import all your tax information into TurboTax from Stash. The above link should take you to your documents.

Savings and price comparison based on anticipated price increase. Scroll down to the Documents section and click Portfolio. Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns.

Stash tax documents turbotax create innovative ways. Login to your Stash account. Paying your taxes can treat like god big complicated job.

Up to 20 off TurboTax. Have made money from selling investments. Have a Retire account and made a contribution to it for the specified tax year.

Yes dividends are taxed as income because they are money that you are making off of the money you have invested. Before you file your return get it reviewed by a tax specialist to ensure that your specific tax situation is handled correctly. Now you can automatically upload your Stash tax documents with TurboTax.

The 1099-DIV is a common form which is a record that Stash not your employer gave or paid you money. If you have any questions regarding taxes within your Stash account. The 1099-DIV is a common form which is a record that Stash not your employer gave or paid you money.

Even if you bought shares at various dates or at different prices it will automatically calculate your right basis. If these scenarios dont apply to you you. Click Tax Documents for each Stash account.

Up to 20 off TurboTax. Yes Im aware that nobodys having the best of luck in the stock market this. You sold an investment in your Stash Invest account in 2021.

If you have any questions regarding taxes within your Stash account. Please address specific questions on taxes to a tax professional. Select Statements Tax Documents from the menu on the left.

Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns. Now youve got the documentation you need to declare any income or loss you may have realized in your Stash. All tax reports and forms prepared are in compliance with local tax rules.

E-file fees do not apply to New York state returns. Only enter account numbers for Stash accounts with 2021 tax documents listed. It warm not intended and be relied upon concrete legal accounting or life advice.

Please note that nothing written in this article should be construed as investment legal or tax advice. The easiest way to do this is through the Stash app under SettingsStatements and DocumentsTax Documents. Category Cryptocurrency Tax Calculator.

1099-DIV 1099-B etc at the top of pg. Stash is not a bank or depository institution licensed in any jurisdiction. Click Tax Documents - now youve got the documentation you need to declare any income or loss you may have realized from the previous tax year.

Review the tax documents provided by Stash. Earned more than 10 in dividends andor interest. If you earned more than 10 in dividends from your Stash investments youll receive a 1099-DIV.

If you didnt get an email about tax forms and arent seeing any in your account its because you dont need them for this tax year. Coinpanda was created with the goal of making reporting crypto taxes simple quick and accurate. Navigate to the account type you are looking for documentation on.

Yes dividends are taxed as income because they are money that you are making off of the money you have invested.

Turbotax Direct Import Instructions Official Stash Support

Hackers Begin Spoofing Fintech Apps As Tax Season Approaches

Hackers Begin Spoofing Fintech Apps As Tax Season Approaches

How To File Robinhood 1099 Taxes

Turbotax Taxcaster Free Tax Calculator Free Tax Refund Estimator Tax Refund Turbotax Tax Free

Irs Tax Forms What Do I Need To File My Tax Return In 2022 Money

Stash App Taxes Explained How To File Your Stash Taxes Youtube

Turbotax Direct Import Instructions Official Stash Support

Turbotax Review A Leader In Diy Taxes

Turbotax Review A Leader In Diy Taxes

Import Your Investment Results Into Turbotax Youtube

Turbotax Direct Import Instructions Official Stash Support

Turbotax Direct Import Instructions Official Stash Support

Turbotax Review A Leader In Diy Taxes

Turbotax Makes Filing Almost Fun Inside Design Blog Free Tax Filing Filing Taxes Turbotax

Turbotax Review A Leader In Diy Taxes

Turbotax Taxcaster Free Tax Calculator Free Tax Refund Estimator Tax Refund Turbotax Tax Free